Never Chase Stocks

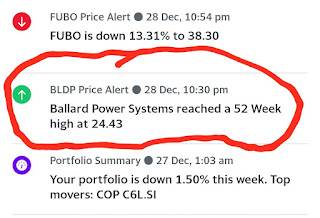

Never Chase a stock that has peaked. Today, impulse and fomo took over me. Queued to buy BLDP at US$23.90... the support level... Done! Lost some money. Let's be disciplined and stick to my checklist. Rookie Daily (Not Day) Trader premarket Checklist: 8.30am NY time: Watch TraderTV Live ... get stock hints... get the feel... 3 hours. Check MarketWatch Premarket Leaders ... pick and analyze rising stocks. Check Yahoo Finance Earnings Calendar ... pick stocks that have not jumped. Check Mergers and Acquisitions at MarketWatch , Reuters , and CNBC . Strategy formed from real life lessons: Trust Supertrend... Ignore the news analysis (remember the missed Tilray stock that went up 26% in a day) Buy on Supertrend Buy signal (remember the missed opportunities in the buy watch list) Sell on Supertrend Sell signal for losing stocks (remember the gradual -30% Nikola drop) Sell losing stocks to keep cash rolling. It's better than missing opportunities without funds. Just buy whatever hun...