Best Trend Reversal Indicator For Stock Trading

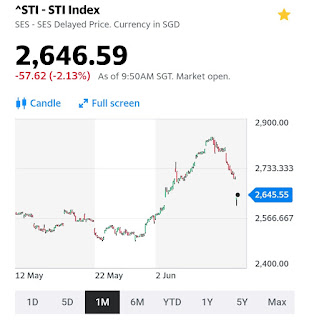

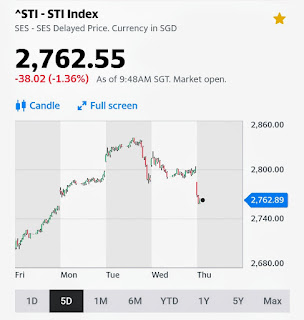

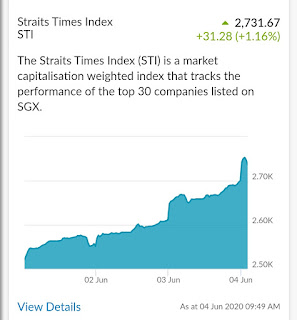

MACD indicator... The histogram and the line crossing the zero level is a good reversal signal. Note that the zero level must be crossed by the two lines. If the histogram crosses the zero level but the line doesn't, you don't open a trade. Source: https://pipbear.com/indicator/trend-reversal/#:~:text=MACD%20indicator,-While%20MACD%20can&text=The%20green%20histogram%20and%20the,don't%20open%20a%20trade . That means right now there maybe a downtrend confirming soon. Singapore stocks opened generally higher today. I have nothing to buy and nothing to sell. Let's take a break. Adrian's Journal The rookie trader