Sembcorp Marine Rights Issue - What to do?

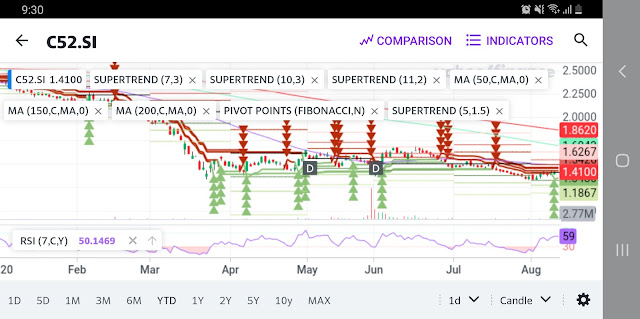

I have 3 options: do nothing sell the rights subscribe 1. Do Nothing There is no cash outlay but if I let the rights lapse I will then see my stake diluted when the exercise is completed. 2. Sell the rights I can sell their rights in the market, so this option results in cash inflow . The rights appear on the Singapore Exchange's website as "Sembcorp Marine R". https://sg.finance.yahoo.com/quote/THFR.SI?p=THFR.SI&.tsrc=fin-srch As the rights have an expiry date, the value of the rights will fall closer to the expiry date. 3. Subscribe This involves cash outflow and would entail paying SMM S$1 to get five new shares for each share currently held. This option would be suitable if I have faith in SMM's long-term future. Which should I choose? I want liquid cash to buy other stocks. So maybe I should sell the rights. In that case I must subscribe first! It might not be a good idea to throw good money after bad. Shareholders may wish to think twice before subs