Aug 2023 BRO ACE Stock Trading Strategy

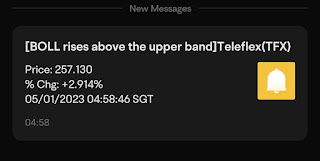

It's 3 August 2023... the Rookie Trader discovered a flaw in the BRO ACE buy strategy. When "A" triggers the buy signal, the Target may not be coming but may have just passed. Mistake done in AMD purchase. So the new rule is: never buy if Target has been reached in the last 3 months. ======== ROOKIE STOCK MARKET STRATEGY DAILY CHECKLIST Identify stock holdings to SELL. Use BRO (Moomoo) and ACE (Yahoo Finance). All 3 must meet the criteria... BOL (20, C,2). Above Upper Band (sell). RSI (7). Cross above 70 (sell). OBV. Reach a 3-month high (sell). A. Average Analyst Price Target is equal to or less than price (otherwise let the profits run). Remember... Never expect the price to return to its previous high. Sell on signal even if it's a loss (capital cashflow is better than stuck or falling losses) Identify stocks to BUY Buy only S&P500 stocks... for stability and dividends. Use the Moomoo stock screener to screen SP500 stocks with a daily Bollinger indicator