3 Supertrend Technique

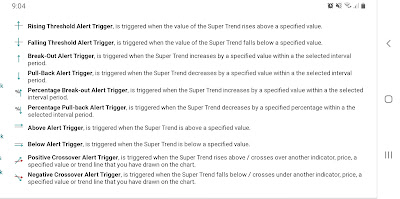

Watching this video again and learning more details about using Supertrend indicators. https://youtu.be/qMuWo9nvK The 3 supertrend setups... - 7,3 - 10,3 - 11,2 How to use... 1. Wait for 3 red or 3 green supertrend to form. 2. Long or short on the 3rd Supertrend after candlestick closes. 3. Exit when the price touches the supertrend line. Which time frame to use? - Intraday trading - 5, 10, 15 min - toggle among all 3 to confirm a signal. Let's try it. - the rookie trader