Rookie Swing Trader Journal 29 Jun 2021 - What is Japanese Candlestick Doji pattern?

What stocks to buy today from my Moomoo watchlist?

- Buy TNXP (lower BB) at $1.10

- Buy PULM (kdj) at $1.00

How's my purchasing power today?

- I can buy 2 stocks using Moomoo.

Any stocks to add to the watch list from the Moomoo Heat List and Market Opportunity KDJ Golden Crossing, Bollinger Band Breakout, Old Duck Head, Yahoo Finance?

- None

Any tips from TraderTV Live?

- None

Which stock in hand can I sell?

- ADVM. Bought $4. Stop $3.47. Target $4.40.

- METX. Bought $1.60. Stop $1.53. Target $1.90.

- AAPL. Bought $125. Target $138 or cut at KDJ dead fork.

- VISA. Bought $233.27. Target $256 or cut at KDJ dead fork.

- ZOM (kdj). Bought $0.84.

How to track medical biotech stocks, meme stocks, and penny stocks... As well as any popping stock?

- New strategy using Moomoo.

- Started on 7 June 2021.

- Scan Trade Heat list to look for 3 signals.

- 1st signal - Buy on KDJ Golden Crossing

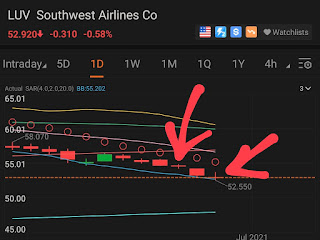

- 2nd signal - Confirm uptrend with SAR and MA.

- 3rd signal - Double confirm with Oversold Analyses.

- Complement with Bollinger Band Breakout strategy.

- Sell on opposite signals.

What happened?

- See above

What worked? Why?

- Cutting loss before it hits -$100. Why? More capital to buy rising stocks.

What did not work? Why?

- Stocks selected are rising too slow. Why? Bought mostly big established stocks like AAPL and VISA.

What did you learn?

- What is the Japanese Candlestick Doji Pattern?

- A Doji occurs when the opening and closing price is the same (or close to it). Many traders think that this candlestick pattern is one of the best ones to trade...

- ... a Doji is only significant after an extended move to the upside (for a short setup) or an extended move to the downside (for a long setup). Also, the Doji should be at a support or resistance area.

- Reference: https://www.swing-trade-stocks.com/doji-candlestick-pattern.html

- Maybe I should go back to look at Yahoo Finance charts.

What can be done better?

- Criteria for finding swing stocks to buy...

- RSI <30 oversold

- Uptrend

- High volume

- 5 days down pattern

- Japanese candlestick Doji pattern

- Learn swing trading here... https://www.swing-trade-stocks.com/index.html

What will stop you?

How to overcome the challenges?

Until tomorrow.

~ Rookie Trader

PS: I would like to thank the following...

- For the charts... https://finance.yahoo.com/

- For the analysis... https://tradertv.live/

- For all in one... https://j.moomoo.com/005lWj

Buy Crypto? Binance SG.

Footnote to self:

- Buy Market price when I see a signal. Don't buy at a Limit price.

- Buy on dip from late April to early May 2021.

- Sell in May and go away. Reinvest in November.

- August is a particularly strong month, September is an especially bad month for stocks.

- 10% strategy is not efficient. 5% profit is faster to reach. Hence Change to >$100 target strategy instead.

- Buy quickly once I identify a stock to buy.

- Queue GTD for every buys and sells.

- Missed SEAC spike 3 times within a week. Dropped to negative immediately after the spike. Lesson - Queue up to sell using GTD. Forget about using alerts.

- Premarket moves are irrelevant and distracting. Stop tracking them.

- Sell immediately if price spikes on news.

- Remove emotion from the equation.

- Sell. Don't hold. Don't be greedy.

- Sell when the target is hit. Don't hold.

- I need a cut-loss strategy.

- If I don't sell, I will have no capital to buy.

- Locking the profits at hand is better than risking the opposite direction.

- How to recover from stock market losses? How to recover my money lost? How to win my trading losses back?

- The best way to recover after losing money in the stock market is to invest again.

Comments