Apr 20 - Supertrend Trading Journal 2021 - PULM MSFT TNXP

1 hour before the market opens...

How's my purchasing power today?

- I can buy 4 stocks.

What's SwaggyStocks saying about Wallstreetbets ticker sentiment?

- Today. GME CLOV TSLA

- Yesterday. GME CLOV TSLA

Any stocks from MarketInOut.com to buy?

- None.

Are any stocks in my Yahoo Finance watchlist meeting my Supertrend buy criteria?

- Biotech stocks

- Buy TNXP at $0.97? Done. Target $1.22. Stop $0.86.

- Buy HOTH at $1.46? Missed. Went up 30%.

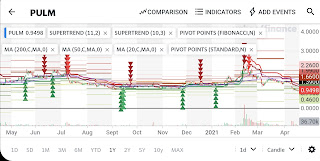

- Buy PULM at $0.94? Done. Target $1.06. Stop $0.79

Any tips from TraderTV Live?

- Buy on dip from late April to early May 2021.

- Cathie Woods reference.

Question: 👉 How to track medical biotech stocks, meme stocks, and penny stocks?

Which biotech stocks are ready to break out, pop, soar, and explode?

Market opens...

Which stock in hand can I sell?

- GTD Sell MSFT at $260? SOLD.

- GTD Sell IAG at $3.60?

What can I buy from yahoo finance trending stocks?

What can I buy from market movers and related stocks?

Where is the money moving to next?

- Previously. Crypto. Penny stocks. Tech. Banks. Gold

- Today's sector rotation? Crypto.

Explore Finviz screener.

See you tomorrow.

~ Rookie Trader

PS: I would like to thank the following...

- For the charts... https://finance.yahoo.com/

- For the analysis... https://tradertv.live/

- For the supertrend screener... https://www.marketinout.com/

- For the sharing... https://anchor.fm/swingtrading/

PS: What did I learn today?

- Sector rotation strategy.

- Look at top industry groups: Keep an eye out for those that jump into the top 20.

- When a market uptrend warms up, more breakouts tend to come from the same sectors or industry groups.

- ~ https://www.investors.com/how-to-invest/investors-corner/want-to-spot-sector-rotation-in-the-market-employ-multi-channel-thinking/

- Compelling evidence shows that long-term investors will be rewarded for their patience with underperforming sectors and short-term underperformance against the S&P 500 in a well-diversified portfolio.

- ~ https://www.forbes.com/sites/frankarmstrong/2020/11/25/sector-rotation/

What did I learn previously?

- 5% profit is faster to reach than 10%. Hence Change strategy.

- Buy early when I identify one stock to buy.

- 10% strategy is not efficient. Change to $100 strategy instead.

- Missed SEAC spike 3 times within a week. Dripped to negative immediately after the spike. Lesson - Queue up to sell at 12%. Forget about using alerts.

- Premarket moves are irrelevant and distracting. Stop tracking them.

- Buying at the market close is not a good idea. Too many premature supertrend false alarms. Stop trading from 3 to 4 pm.

- Sell immediately if price spikes on news.

- Check yahoo finance trending stocks.

- Missed the NFT STOCKS!!!!! Pay attention next time follow the trend.

- Follow most-watched stocks on yahoo finance coz they are more volatile.

- I need a supertrend screener.

- I missed many buy signals in the travel industry. So please Monitor all related big movers every day.

- Remove emotion from the equation.

- Sell. Don't hold. Don't be greedy.

- Sell when the target is hit. Don't hold.

- I need a cut-loss strategy.

- If I don't sell, I will have no capital to buy.

- I have a problem deciding whether to sell or hold.

- I should have held the stock that rose 100% times up.

- It's easy to buy them using a supertrend buy signal.

- 10% is my target but is there a way to tell it will rise higher?

- Let's try this after hitting 10%...

- If the price is above the next black pivot point, then hold.

- If the price touches the next pivot point first resistance, then all the more hold.

Comments