PFE vs MMM, Which Stock to Buy for Potential 10% Gain?

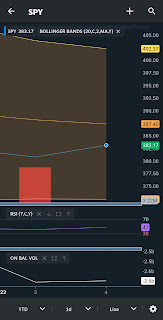

I am considering buying either PFE or MMM, as both have the potential to go up by 10%. (Using ORB Strategy) After researching, I have found that PFE is more undervalued than MMM. (Simply Wall Street) Therefore, I have decided to queue for PFE at a low of $44. If you're interested in joining me, I suggest signing up for Moomoo now. You can even get 1 free share worth S$35-200 as a Welcome Reward! Here's the link to sign up: https://j.moomoo.com/00vPQ1 ~ The Rookie Trader Rookie ORB Stock Trading Strategy - Jan 2023